Disclaimer: Crypto is highly volatile and you could lose all your money, do your own research before investing.

Key Takeaways

- Michael Saylor, Executive Chairman of MicroStrategy, downplays the significance of owning 7% of Bitcoin’s supply, citing the long-term scarcity of BTC.

- Saylor’s stance reflects a deep belief that Bitcoin is still in its infancy in terms of adoption and value appreciation.

- He frames MicroStrategy’s position not as dominance, but as strategic foresight in a market that will eventually be led by sovereign wealth and institutional capital.

- The statement underscores the belief that Bitcoin’s ultimate role will be that of a global monetary network, beyond speculative trading.

- Saylor’s comments continue to shape institutional sentiment, reinforcing Bitcoin’s narrative as “digital property” rather than just a cryptocurrency.

Introduction to Saylor’s Bitcoin Philosophy

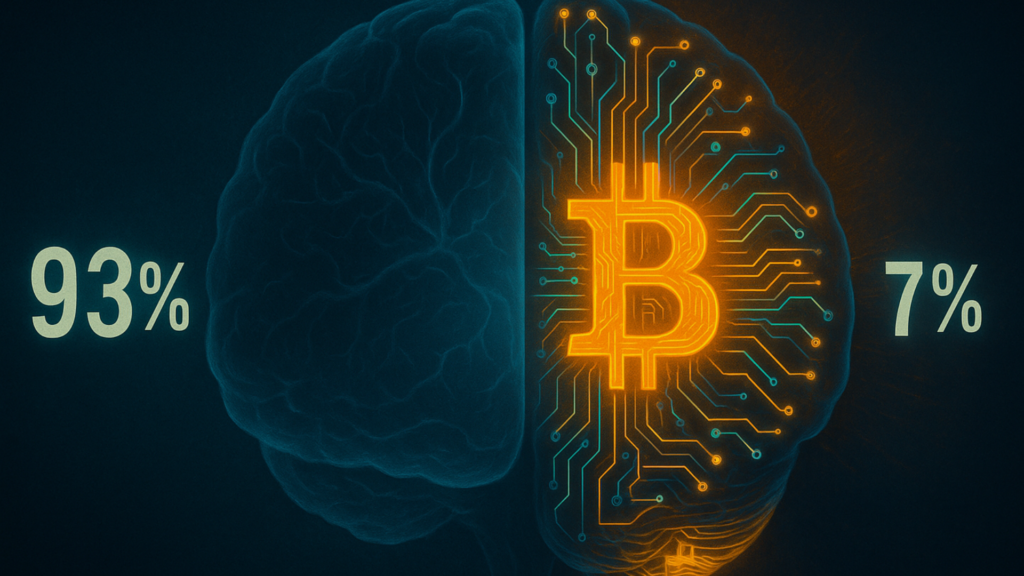

Michael Saylor has become synonymous with institutional Bitcoin adoption, spearheading MicroStrategy’s $5+ billion BTC holdings. As one of the largest corporate holders of Bitcoin, Saylor’s voice carries immense weight in the crypto landscape. Recently, his statement that “owning 7% of Bitcoin isn’t much” turned heads—not because of its factual inaccuracy, but because of the philosophy it reflects.

Rather than boast about MicroStrategy’s influence over Bitcoin’s supply, Saylor used the moment to emphasize that this percentage will seem trivial in hindsight. According to him, the real BTC demand is still to come—from governments, megabanks, and billions of users—not just tech-forward companies.

MicroStrategy’s Bold Accumulation Strategy

MicroStrategy has transformed itself from a business intelligence company into a Bitcoin proxy investment vehicle. Since 2020, Saylor has consistently directed corporate funds—and later, debt-fueled capital raises—into acquiring BTC. This relentless acquisition strategy now places MicroStrategy’s holdings at over 1% of all BTC ever to exist, and roughly 7% of all Bitcoin currently in circulation.

Signup on Bybit and receive 100USDT as welcome bonus

But rather than frame this as dominance, Saylor maintains it is merely a foothold in what he views as the world’s hardest asset. His assertion that “7% isn’t much” stems from his belief that the current market remains underestimating Bitcoin’s potential scale.

Perspective on Bitcoin’s Future Market

When Saylor says 7% is “not much,” he’s speaking relative to the future scale of Bitcoin. He foresees a time when sovereign wealth funds, central banks, and institutional balance sheets will allocate to Bitcoin similarly to how they hold gold or U.S. treasuries today. In that future, MicroStrategy’s current holdings—massive by today’s standards—will appear proportionally smaller.

If Bitcoin reaches a global monetary role with a $10 trillion or even $100 trillion market cap, then 7% of today’s limited 21 million supply is not a position of overreach but of early conviction. His comment reflects long-term vision over short-term metrics.

The Idea of Digital Scarcity as a Global Magnet

Saylor has frequently described Bitcoin as “digital property,” a form of wealth storage that transcends national boundaries and inflationary risk. His minimization of MicroStrategy’s current share signals a belief that BTC’s real value lies in its extreme scarcity. With only 21 million BTC ever to be minted—and much already lost—holding even a fraction becomes increasingly valuable as adoption scales.

Signup on Bybit and receive 100USDT as welcome bonus

From Saylor’s perspective, true digital scarcity will eventually attract trillions of dollars in capital, and his company is merely preparing for that inevitable revaluation. His comment isn’t about modesty—it’s about illustrating how small today’s markets are compared to tomorrow’s.

Bitcoin vs. Traditional Assets: A Shifting Investment Thesis

Saylor often contrasts Bitcoin with traditional asset classes like real estate, stocks, and government bonds, which can be diluted, taxed, or manipulated by policy decisions. Bitcoin, by contrast, is governed by mathematical scarcity and decentralized control. This is the core of his thesis: that Bitcoin will eventually be considered pristine collateral—an apex asset that institutions gravitate toward not because it’s trendy, but because it’s logically superior in terms of preservation.

From this angle, 7% of Bitcoin isn’t a power grab—it’s an insurance policy against systemic risk and inflation. The idea is that today’s “large” Bitcoin positions may soon appear modest against the backdrop of global portfolio realignment.

Public Reaction and Misinterpretation of the Statement

Saylor’s statement was met with a mix of admiration and critique. Some hailed it as a humble reminder of Bitcoin’s growth potential, while others perceived it as tone-deaf or dismissive. After all, most retail investors can’t dream of owning a fraction of 1% of Bitcoin’s supply, let alone 7%. But what critics miss is that Saylor’s point isn’t about bragging rights—it’s about scale. He’s painting a macroeconomic picture, not flexing corporate dominance.

His critics, often viewing the market through short-term price action, miss the broader implications of what it means if Bitcoin truly becomes a multi-trillion-dollar asset.

MicroStrategy’s Role in Institutionalizing Bitcoin

Regardless of interpretations, Saylor’s leadership has played a pivotal role in pushing institutional Bitcoin adoption. MicroStrategy was one of the first publicly traded companies to convert its treasury into BTC, sparking a trend followed by Tesla, Block, and others. The company’s consistent messaging, corporate strategy, and willingness to embrace volatility have made it a bellwether in the space.

When Saylor says “7% isn’t much,” he is continuing to frame MicroStrategy not as a kingmaker, but as a responsible, long-term player in a still-nascent asset class. It’s a positioning that helps maintain investor confidence while advancing Bitcoin’s legitimacy.

Global Demand Will Dilute All Early Holders

Saylor’s deeper implication is that over time, the entrance of larger players will reduce the relative influence of early holders like MicroStrategy. In a world where nations begin holding Bitcoin in their reserves, and where investment banks offer BTC-backed instruments to clients, current corporate and individual positions will naturally diminish in relative weight.

The Bitcoin supply is fixed, but demand will grow exponentially. Saylor is essentially warning that even those who feel “early” now may find themselves dwarfed by future inflows. This is not just a technical assessment but a strategic call to action for other institutions.

A Call to Accumulate, Not Celebrate

Rather than view their BTC holdings as an end goal, Saylor’s team sees them as a foundation for continued accumulation. His statement subtly reinforces MicroStrategy’s ongoing commitment to buying more Bitcoin, not sitting on laurels. The company continues to raise capital, issue convertible notes, and explore financial instruments that allow it to increase its holdings.

Far from claiming dominance, Saylor is making the case that there’s still time to accumulate and that today’s valuations don’t yet reflect Bitcoin’s true utility. The message is clear: if MicroStrategy can buy more, why wouldn’t you?

Conclusion

Michael Saylor’s assertion that “owning 7% of Bitcoin isn’t much” is far more than a quip—it encapsulates his entire investment philosophy and long-term worldview. He isn’t downplaying MicroStrategy’s influence out of modesty, but rather highlighting how early we still are in Bitcoin’s evolution. In a future where BTC could underpin sovereign treasuries and act as a digital foundation for global finance, today’s dominant positions will look relatively small.

Through this lens, Saylor’s comment isn’t a boast—it’s a strategic prediction. He believes the floodgates of institutional and government capital are only just beginning to open. And when that capital finally flows into Bitcoin, today’s percentages will seem insignificant compared to the magnitude of tomorrow’s demand.

In an environment where speculation often dominates headlines, Saylor remains one of the few voices consistently pushing a long-term, fundamentally driven Bitcoin narrative. His strategy, while aggressive, is anchored in a belief that BTC will eventually be as indispensable as gold once was—and maybe more. Whether one agrees with his philosophy or not, there’s no denying that his bold vision continues to shape how the world views Bitcoin’s future.